Navigating clients’ life transitions, the post office’s year-end surprise, and real estate as a charitable planning tool | Advisor Newsletter (February 2026)

We hope you are staying warm during these winter months.

We appreciate the opportunity to work with you! The Community Foundation of Southern Indiana is always honored to hear from attorneys, CPAs, and financial advisors as you serve your philanthropic clients.

As you work day-to-day with charitable individuals and families, you know that philanthropy rarely exists in a vacuum. It intersects with life events, tax rules, emotional decision-making, and the types of assets your clients actually hold. Our team is here to help you navigate those intersections with clarity and confidence – especially when clients are facing change, uncertainty, or complexity.

Here’s what we’re covering this month:

Charitable planning during life’s sudden changes. Clients often make their most consequential financial and estate planning decisions during periods of upheaval – after a divorce, the loss of a spouse, retirement, or an unexpected shift in assets. When clients feel overwhelmed, charitable giving can help re-center decision-making around values and purpose. Learn how the community foundation’s tools can help your clients move from reactive choices to intentional action during life’s inevitable transitions.

A year-end rule change that caught many people by surprise. If your clients mailed charitable gifts at the end of 2025, the U.S. Postal Service’s change to how postmarks are applied may have real implications for charitable deductions. We’ll help break down what changed, why it matters, and how you can help clients document and, in some cases, preserve deductions they intended to claim for 2025.

Real estate as an underutilized charitable asset. Although real estate represents a significant portion of many clients’ wealth, it remains one of the least used assets in charitable giving. As property ownership continues to shift across generations and clients reassess underused or burdensome real estate, gifts of appreciated property may play an increasingly important role in philanthropy. Lean on the community foundation as you explore key planning considerations, technical requirements, and opportunities for converting real estate into flexible charitable tools.

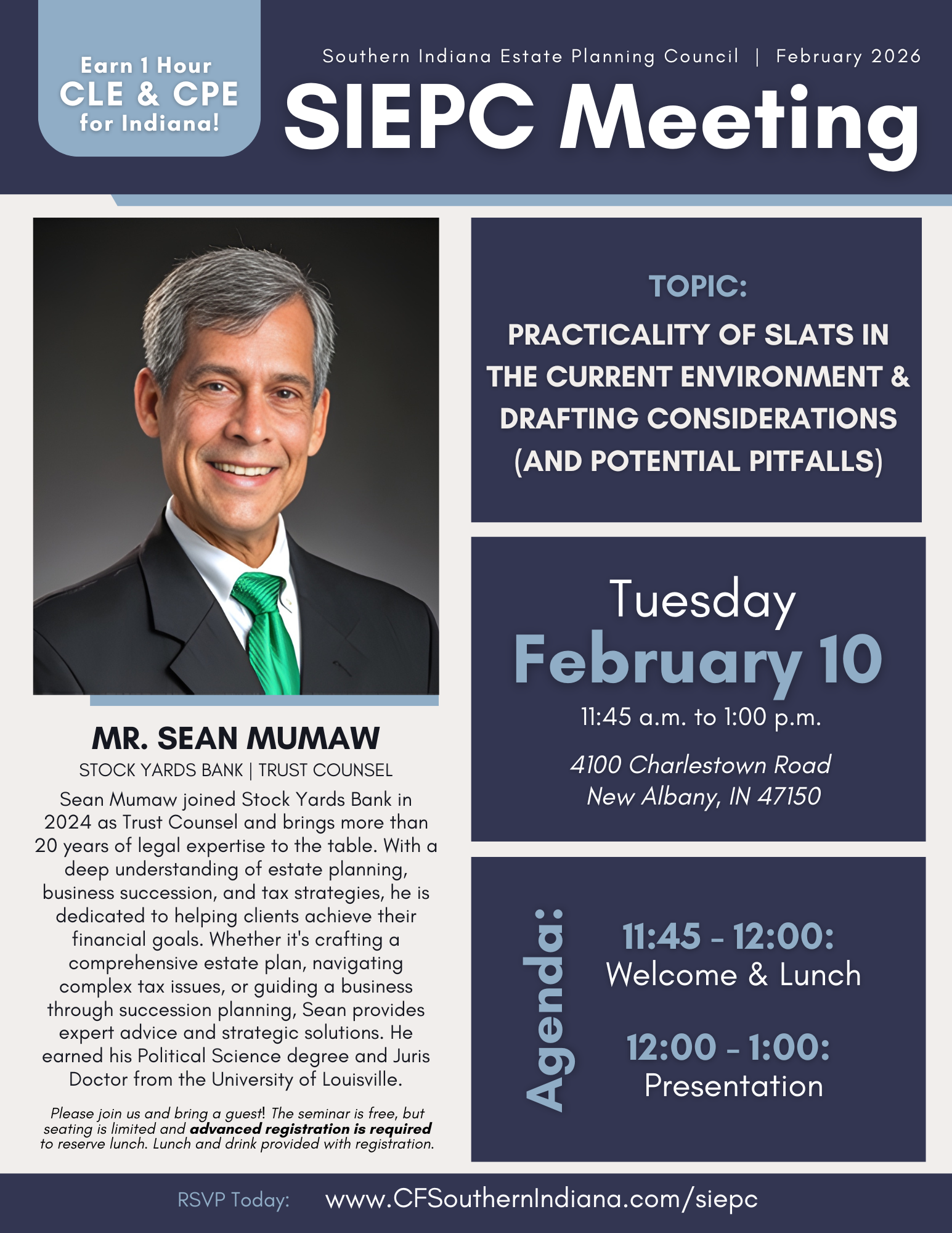

February SIEPC Event: You’re invited to join the Southern Indiana Estate Planning Council for its February meeting, which will feature Mr. Sean Mumaw speaking on “Practicality of SLATs in the Current Environment & Drafting Considerations (and Potential Pitfalls)”. The seminar is FREE, but seating is limited and advanced registration by Monday, February 9 is required to reserve lunch. One hour of CLE credit for Indiana is also available at no cost. Guests are welcome to attend one meeting; continued participation requires membership in the SIEPC.

As always, our team is here to support you and your clients. Whether you’re helping a client navigate a life transition, untangle a technical rule change, or explore creative ways to give using non-cash assets, we are honored to serve as a resource and collaborative partner. Please don’t hesitate to reach out – we look forward to working with you.

Sudden life changes: Charitable giving can help clients get through it

by Linda Speed, President & CEO

As an attorney, CPA, or financial advisor, you are no stranger to witnessing the ripple effects of life’s unexpected curveballs. If you represent a client over many years, you’re very likely at some point to help the client through a serious illness, a loved one’s death, business challenges, marital dissolution, strained relationships with children, or all of the above.

Research and survey results tell us that many clients’ most consequential estate and financial planning activities arise not from long-term intentions, but from sudden change. Moments like this are challenging because clients are often overwhelmed and unsure how to proceed, and even the best advice can feel like too much information delivered too soon. In these situations, be aware that charitable planning can help re-anchor clients’ decision-making in values rather than fear or urgency. For many clients, generosity is one of the few topics that still feels familiar when everything else is shifting.

Here are three examples:

Change in assets

Following a divorce settlement, a client may suddenly be holding cash, concentrated stock, or other highly appreciated assets. The client may also be juggling other priorities: adjusting lifestyle expectations, supporting adult children, and rethinking an estate plan. When the client also wants to do something charitable but isn’t sure yet what organizations to support, setting up a donor-advised fund at the community foundation can be a natural fit in some cases, allowing the client to be eligible for a tax deduction when the contribution is made while taking time to decide which charities to support and when.

Loss of spouse

A client whose spouse has recently passed away may want to make a charitable gift in the spouse’s memory, but likes the idea that the gift could benefit the community for many generations and address urgent needs that arise decades from now. Setting up an unrestricted fund at the community foundation allows a client to support evolving community needs over time as well as support the mission of the community foundation itself.

Retirement

A 74-year-old client who just retired is feeling less “relevant” outside of the workforce, and therefore would like to do something meaningful for the community. With plenty of assets in retirement accounts, the client does not need to rely on distributions from IRAs to maintain lifestyle standards. This client could be a good candidate to establish a designated fund (to support a specific nonprofit organization) or a field-of-interest fund (to support an area of need such as education, health care, or the arts) at the community foundation. Then, the client may direct Qualified Charitable Distributions from IRAs (up to $111,000 per taxpayer in 2026) to the fund, bypassing adjusted gross income and counting toward required minimum distributions.

The community foundation is happy to help. Next time you are meeting with a client who is experiencing one of life’s inevitable rough patches, remember that charitable planning allows your client to take action that brings joy, reflects identity, aligns with purpose, and helps the client shift from a reactive mode to an intentional one.

Postmarks, rule changes, and remedies for clients’ 2025 charitable gifts

by Linda Speed, President & CEO

If you were surprised to read about the ripple effect of a seemingly small change in the U.S. Postal Service regulations late last year, you were not alone! Here’s what you need to know, including potential remedies for your clients whose 2025 charitable deductions may be impacted by the rule change.

What’s the background with the IRS?

Under long-standing IRS guidance, a charitable contribution is generally considered “made” for tax purposes when the donor irrevocably parts with control of the gift. For contributions made by check and sent through the mail, the IRS has traditionally treated the date of the U.S. Postal Service postmark as the date of the gift, even if the charity receives the check later. This approach is reflected in IRS Publication 526 and generally parallels the broader “mailbox rule” under Internal Revenue Code Section 7502, which treats certain documents and payments as timely based on their postmark date rather than the date of receipt.

Okay, so if this is not an IRS issue, what happened?

In November 2025, the U.S. Postal Service (not the IRS) changed how postmarks are applied. Effective December 24, 2025, the official postmark date is now defined as the date of the first automated processing scan at a USPS processing facility, rather than the date a letter is dropped in a mailbox or handed to a clerk at a local post office. As a result, mail deposited on December 31, 2025 may not have actually received a postmark until several days later, especially around the holidays. This change took many people by surprise and created a lot of confusion, prompting the USPS to issue a “facts and myths” circular.

So what’s this got to do with the IRS?

Because the IRS’s practices continue to rely on the postmark to establish the date of a mailed charitable gift, this change can cause a contribution a client intended to deduct for 2025 to be treated as a 2026 contribution if the postmark reflects a January processing date.

If my client got caught up in this change, is the client totally out of luck for a 2025 charitable deduction?

Not necessarily. Remember, the underlying IRS rules governing charitable contribution timing have not changed. Publication 526 still requires your clients to “substantiate”—meaning document—the date of their gift, and the IRS continues to look at objective evidence to substantiate and determine when the contribution was made. What has changed is the ability to rely entirely on an ordinary envelope postmark as proof of a year-end gift. (Advisors should understand that the statutory mailbox rule in Section 7502 is primarily directed at tax filings and payments to the IRS, but in practice the IRS uses similar concepts when evaluating the timing of charitable gifts, particularly where the postmark is the primary evidence of mailing.)

Okay, it sounds like all is not lost. What should I do to help my client?

If a client was caught up in this rule change at the end of 2025, the first step is to gather and preserve any alternative proof that establishes when the gift was actually mailed. Documentation such as a USPS Certificate of Mailing, a certified or registered mail receipt, or a manually applied postmark or postage validation imprint obtained at the retail counter can help demonstrate that the donor relinquished control of the gift before year-end, even if the automated processing postmark is later. Even where the client has such postal documentation, contemporaneous records such as copies of the check, the client’s notes, and any correspondence with the charity should also be retained in the event the deduction is questioned. In other words, you may be able to build a case to support a client’s deduction for 2025.

What should clients do for 2026 and beyond?

Advisors should counsel clients on how to avoid this issue going forward. Electronic giving methods such as online donations, ACH or wire transfers, and completed transfers of publicly traded securities provide clearer and more immediate timestamps for deduction purposes and do not depend on postal processing practices.

How can the community foundation help?

Reach out to our team early in the year! Many clients find themselves rushing around at year-end to make charitable donations. The change in the postal rules is a terrific reason to remind a client that organizing charitable giving through a donor-advised fund at the community foundation allows the client to make a donation for tax purposes to the donor-advised fund well before the end of the year, thereby securing any applicable charitable deduction, and then recommending grants from the donor-advised fund anytime to favorite charities.

As always, we look forward to serving you and your clients!

Worth a look: Charitable gifts of real estate

by Linda Speed, President & CEO

If your client base includes philanthropic individuals and families, you’re likely aware that gifts of real estate are an option to fund charitable giving. Real estate is the largest asset class in the world, yet various industry sources suggest that only 3% of charitable giving involves gifts of real estate. Still, it’s understandable that charitable real estate donations are often overlooked; the rules and process are complex. What’s more, many clients struggle emotionally when they start to think about parting with their real estate.

Things might begin to change, however, as real estate ownership changes hands at a rapid pace in the midst of a major transfer of wealth over the coming years. Gen X and Millennials are expected to potentially inherit trillions of dollars in real estate, and that shift has important implications for charitable giving. As more families hold significant wealth in property rather than cash, philanthropy will increasingly involve non-cash assets, especially appreciated real estate. At the same time, many clients are reassessing properties they already own, particularly vacation homes that once felt like a dream but now feel underused, costly, or burdensome.

Given these shifting market dynamics, it is important to be aware of how real estate can be repurposed to support charitable goals in a tax-efficient way. Here are six points to keep in mind:

- Gifts of long-term capital assets, including real estate, are typically eligible for a charitable deduction based on the property’s fair market value, rather than its original cost when they’re given to a public charity. You’ll want to confirm that the property qualifies as a long-term capital asset, since the fair market value deduction is available only for property held for more than one year.

- Your clients can make gifts of real estate to a donor-advised or other type of fund at the community foundation. Because the community foundation is a public charity, when the property is sold, the proceeds can flow into the fund without triggering capital gains tax. This allows a client to convert an illiquid or burdensome asset into a flexible charitable resource that can support favorite causes over time.

- Before your client sets in motion a gift of real estate, please reach out to the community foundation team to help evaluate and coordinate the viability of the gift, as well as offer options for the types of fund or funds to receive the proceeds to achieve your client’s charitable goals.

- Additional considerations include confirming that the property is not encumbered by a mortgage or other debt, which can complicate the gift, evaluating whether depreciation recapture or unrelated business income tax could apply, and determining whether environmental due diligence is required.

- As is the case with any gift of an illiquid asset, documentation and process are critical. Your client must obtain a qualified appraisal to establish fair market value and properly report the gift on Form 8283, and the transfer must be completed using appropriate legal documents, including a deed.

- You’ll also want to ensure that the client has not prearranged a sale of the property (even through casual conversations), which could jeopardize the deduction under the IRS’s anticipatory assignment of income rules or step transaction doctrine. Although the technical requirements can seem daunting, the payoff of a real estate gift can be substantial for both your client and the community. The community foundation is here to help with the charitable aspects of all types of gifts, and real estate is no exception. We look forward to working with you and your clients to help transform real estate into a powerful tool for lasting charitable impact.

Upcoming SIEPC Presentation: Mr. Sean Mumaw on “Practicality of SLATs in the Current Environment & Drafting Considerations (and Potential Pitfalls)”

You’re invited to attend the Southern Indiana Estate Planning Council’s February meeting as our guest, which features Mr. Sean Mumaw speaking on “Practicality of SLATs in the Current Environment & Drafting Considerations (and Potential Pitfalls)”.

The seminar is FREE, but seating is limited and advanced registration by Monday, February 9 is required to reserve lunch. One hour of CLE credit for Indiana is also available at no cost. Guests are welcome to attend one meeting; continued participation requires membership in the SIEPC.

Click here to learn more about the Tuesday, February 10, 2026 event.

Disclaimer: The Community Foundation of Southern Indiana is a resource and sounding board as you serve your philanthropic clients. We understand the charitable side of the equation and are happy to serve as a secondary source as you manage the primary relationship with your clients. This newsletter is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice.